Manappuram Finance took a dramatic hit, crashing around 15% in morning trade. This sharp decline comes in the wake of the Reserve Bank of India’s (RBI) recent decision to take regulatory action against several non-banking financial companies (NBFCs), including Asirvad Microfinance, a subsidiary of Manappuram Finance.

RBI’s Regulatory Action

The RBI’s intervention stems from “material supervisory concerns” regarding the operations of Asirvad Microfinance and three other NBFCs. The central bank has barred these companies from disbursing loans, a move aimed at ensuring compliance with regulatory standards, particularly concerning their pricing policies. The RBI flagged these pricing strategies as excessive and not in alignment with existing regulations.

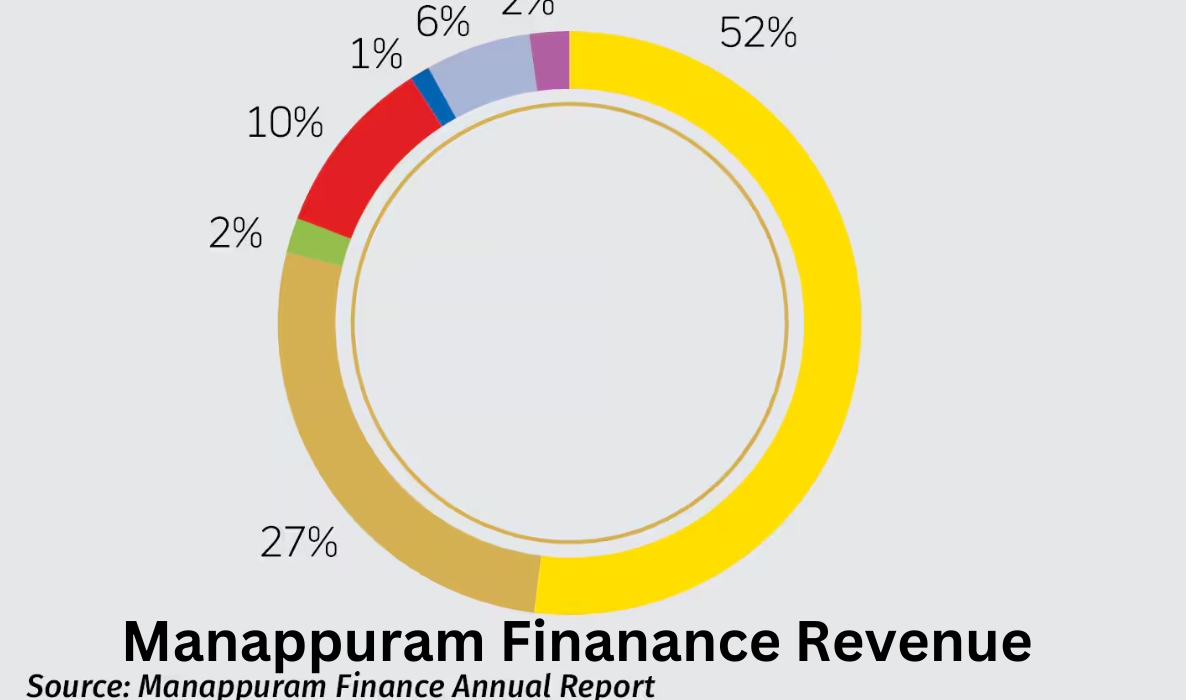

Asirvad Microfinance plays a crucial role in Manappuram Finance’s business model, providing microfinance loans primarily to low-income women. In the fiscal year 2024, this segment contributed approximately 27% to the company’s total revenues.

In response to the RBI’s concerns, Asirvad Microfinance stated, “We value the feedback provided by the honourable Reserve Bank of India and take on record the improvement areas suggested.” The company acknowledged the necessity for immediate action and convened a board meeting to discuss the situation further.

Market Reaction and Analyst Downgrades

The market responded swiftly to the RBI’s announcement. By 10:10 AM on October 18, shares of Manappuram Finance plummeted to Rs 150.73, reflecting a significant loss in investor confidence. This decline prompted several brokerages to downgrade their ratings on the stock, foreseeing potential earnings impacts due to the regulatory restrictions.

Brokerages Weigh In

International brokerage Jefferies downgraded Manappuram Finance to a ‘hold’ rating, expressing concerns that the RBI’s restrictions would adversely affect the company’s earnings. The brokerage highlighted that Asirvad may need to raise capital to maintain its operations, a scenario that could require the parent company to infuse funds if its net worth diminishes.

Bank of America maintained its ‘buy’ recommendation but lowered its target price for the stock to Rs 220 per share. They reduced their earnings forecast by 3-6%, reflecting anticipated moderation in assets under management (AUM) growth for Asirvad. The brokerage noted that Manappuram’s stock has already seen a 25% devaluation over the past three months, suggesting that the market may have already priced in potential growth weaknesses.

Conversely, Morgan Stanley took a more cautious approach, downgrading Manappuram Finance to ‘equal-weight’ and slashing its target price to Rs 170. The firm predicted a significant 30% reduction in consolidated earnings forecasts for FY26-27 and highlighted risks related to loan growth moderation and higher provisioning requirements.

JP Morgan also adjusted its outlook on Manappuram Finance’s bonds, identifying risks related to funding access and borrowing costs. They warned that any capital infusion necessary to address asset quality issues in the microfinance segment could negatively impact the company’s credit ratings.

You May also Like!

- JKPSC KAS Prelims Admit Card 2025: Download Admit Card PDF | Documents to Carry to the Exam Center

- Aakash Chopra Reacts to BCCI’s New Rule Requiring Players to Travel Together for Matches and Practice

- FCI Salary Structure 2025 , Benefits, and Career Growth Opportunities

- Exciting Opportunity, FCI Recruitment 2025 Offers 33,566 Government Jobs with High Salaries

- SSC JE Recruitment 2025, Apply Online for 1701 Vacancies Online

Broader Implications for the Industry

The RBI’s action is not an isolated incident; it follows a series of regulatory advisories directed at gold financiers, including Manappuram and Muthoot Finance. Earlier this year, the RBI restricted these companies from disbursing cash loans exceeding Rs 20,000, emphasizing strict adherence to the Income Tax Act. Additionally, in September, the central bank instructed gold financiers to review their processes and identify lapses within a three-month timeframe.

These measures come in response to irregular practices observed in the gold finance sector, particularly concerning loans issued against pledged gold jewelry. As a result, the RBI is taking a more proactive stance in regulating these companies to protect consumers and maintain financial stability.

Manappuram Finance’s Response

In light of these developments, Asirvad Microfinance has expressed its commitment to addressing the RBI’s concerns. The company emphasized the importance of compliance and pledged to implement the recommended improvements.

The proactive steps taken by Asirvad are crucial, as regulatory compliance not only impacts operational capabilities but also influences investor confidence. Manappuram Finance has historically faced pressure from regulatory bodies, and maintaining a positive relationship with the RBI is essential for its continued success.

Impact

The significant drop in Manappuram Finance’s stock price highlights the critical role that regulatory actions play in the financial markets. As the RBI intensifies its scrutiny of NBFCs, companies like Manappuram and its subsidiary, Asirvad Microfinance, must navigate a challenging landscape. Investors will be closely watching how these firms respond to regulatory feedback and whether they can stabilize their operations moving forward.

As the situation unfolds, the focus will be on how effectively Manappuram Finance can address the RBI’s concerns and restore investor confidence. The coming weeks will be pivotal for the company, as it seeks to not only comply with regulations but also sustain its growth trajectory in a highly competitive and regulated environment.